A well-functioning banking system is the backbone of India’s financial and economic landscape. The system relies on the proper functioning and links between borrowers and lenders. But when borrowers cannot honor their debt, it leads to an increase in stressed assets, non-performing assets (NPAs) and non-performing loans (NPLs) in the system. This results in a decline in the profitability of banks, and also affects India’s economic performance. ARCs like ACRE buy, resolve and turn around assets denominated in INR from distressed to standard state. They thus help unlock the hidden potential of these assets, and play a critical role in driving the country’s economic engine.

Given the investment requirement by ARC’s there is a necessary requirement for strong underwriting

Value from NPAs is, generated by the strength of the platform, the uniqueness of its client franchise, ARC capabilities, and its robust business model

ARCs are now required to build operational efficiencies to actively manage and turn around distressed assets.

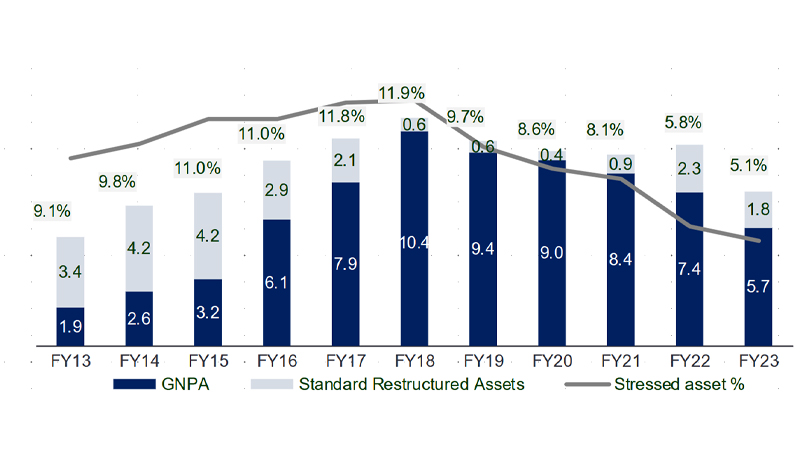

Source: RBI Financial Stability Report & Report on Trend & Progress of Banking in India

Gross Stressed

Assets with

Banks (INR Lakh Cr)

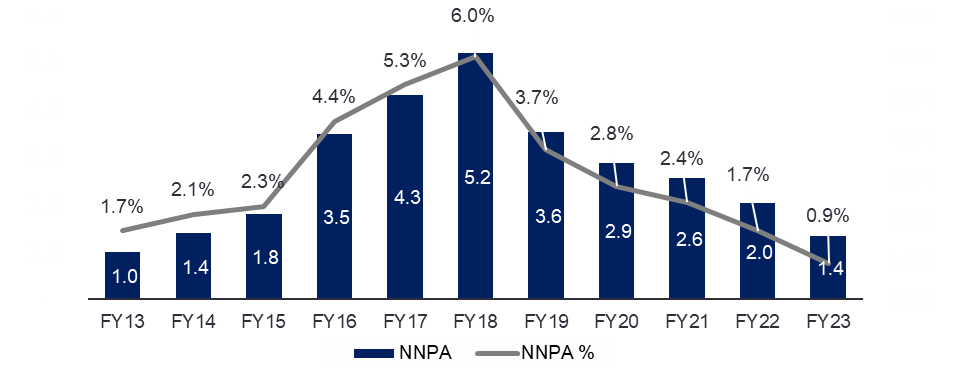

Source: RBI Financial Stability Report & Report on Trend & Progress of Banking in India

Net NPA in

India (INR Lakh Cr)

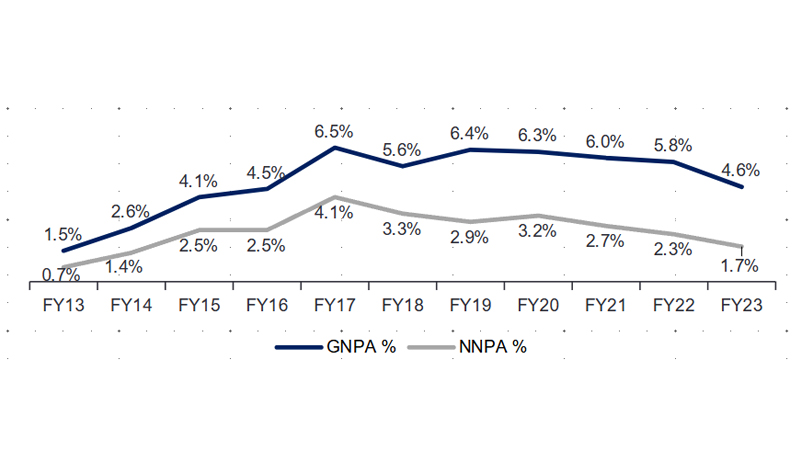

Source: RBI Financial Stability Report & Report on Trend & Progress of Banking in India

GNPA and

NNPA in NBFCs

Master Circular Reserve Bank of India

IBC Circular

2025 Copyright©Assets Care & Reconstruction Enterprise Limited. All rights reserved.